Why Invest?

The Power of Compounding Interest

Compounding interest is a powerful tool that can benefit investors in several ways. Essentially, compounding interest allows investors to earn interest on their initial investment, as well as on the interest that their investment earns over time. This means that over a long period, even a small initial investment can grow significantly as interest is added to the principal amount. By reinvesting the interest earned on their investments, investors can achieve exponential growth over time, which can lead to significant wealth accumulation.

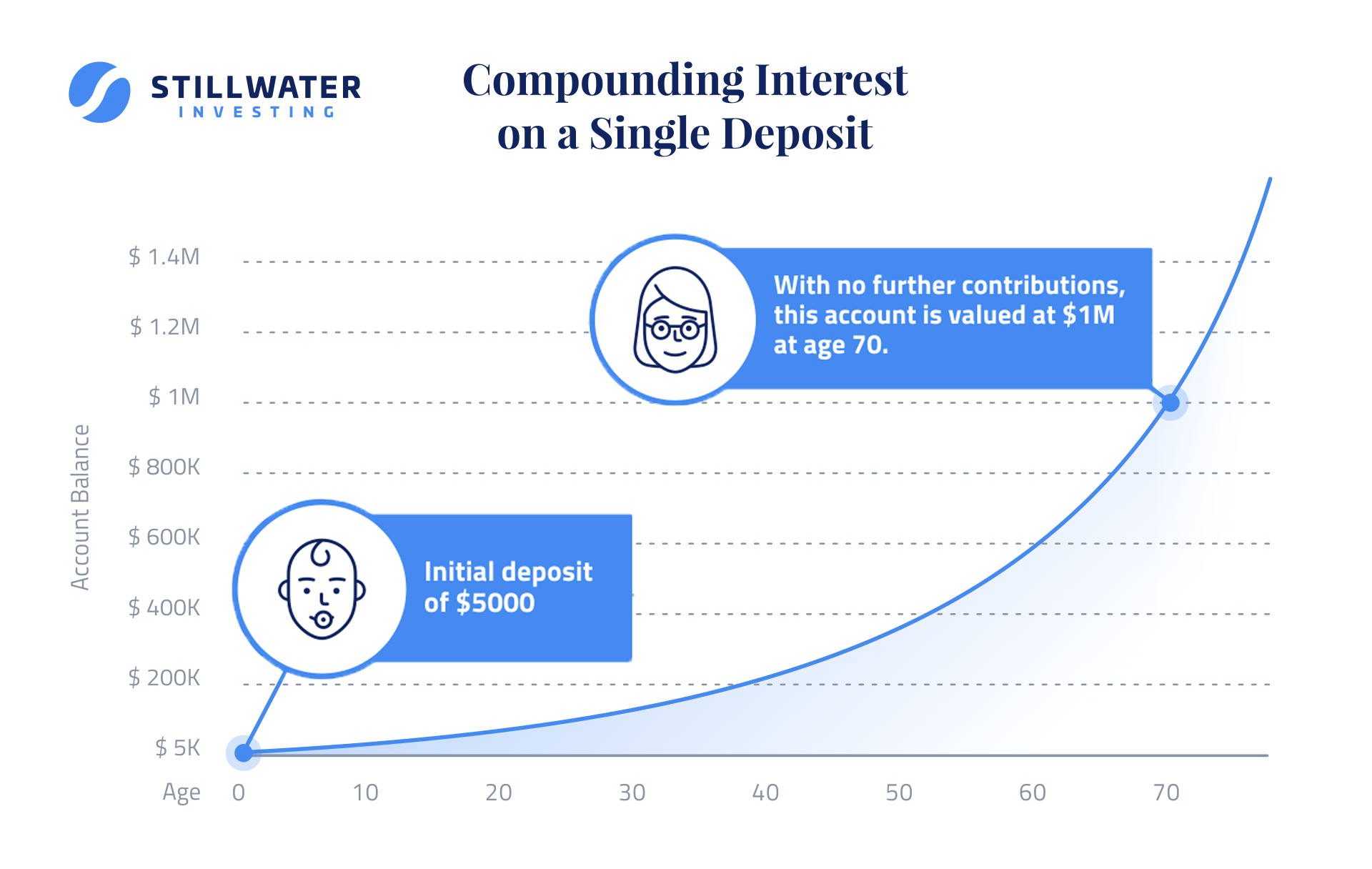

Compounding Interest on a Single Deposit

Jack and Jill have a baby. They create an investment account and make a single deposit of $5000 when the baby is born. The account has an average annual return of 8% in the stock market. Without contributing any more money, that $5000 turned into $1,093,032 after 70 years, all because of compounding interest!

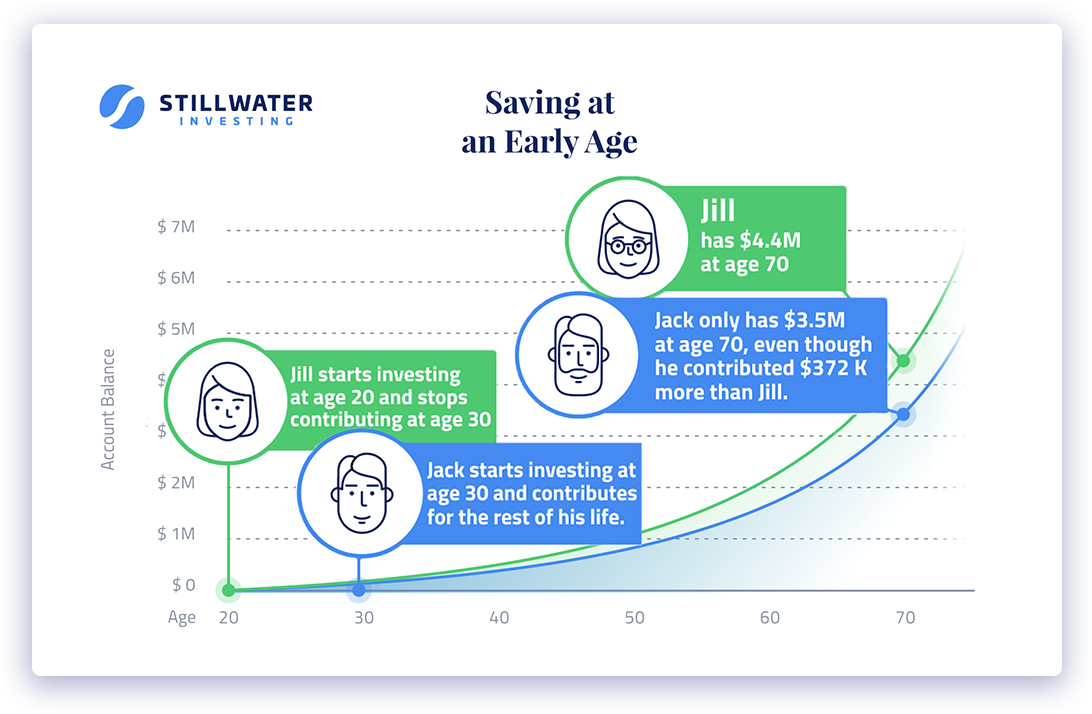

Saving at an Early Age

Jack remembered in his reading that investing at an early age is the best way to build a fruitful retirement account. However, he decided to party hard in his 20’s and make up for lost time in his 30’s by investing for a longer period of time to “catch up”. Jill had a different approach. She decided to save $1000 a month starting at age 20 and stopping at age 30. Even though Jack contributed $1000 a month for the rest of his life, he could never catch up to Jill’s compounding interest (even though he had compounding interest of his own)! At age 70, Jack had $3,491,007 compared to Jill's $4,440,719. Jack contributed $372,000 more than Jill over his lifetime and still had $949,712 less in his account.

Financial Freedom

Warren Buffett, one of the wealthiest investors in the world, is famous for having a calendar with completely blank pages. His reason for this is simple: “I can’t buy time”. This type of financial freedom is attainable with proper investing, and we will work with you to learn your unique situation and how you can utilize Wall Street to empower your life.

Saving at an Early Age

Jack remembered in his reading that investing at an early age is the best way to build a fruitful retirement account. However, he decided to party hard in his 20’s and make up for lost time in his 30’s by investing for a longer period of time to “catch up”. Jill had a different approach. She decided to save $1000 a month starting at age 20 and stopping at age 30. Even though Jack contributed $1000 a month for the rest of his life, he could never catch up to Jill’s compounding interest (even though he had compounding interest of his own)! At age 70, Jack had $3,491,007 compared to Jill's $4,440,719. Jack contributed $372,000 more than Jill over his lifetime and still had $949,712 less in his account.

Optionality

Life comes with many twists and turns, and money buys optionality in both the good times and the bad. The development of a nest egg through investing can alleviate the pressure of future expenses, such as college tuition or unexpected medical bills. Investing also allows you to have a source of passive income. Imagine saving enough money that you could live off the interest and dividends in your account. That would mean any work or activity you do is because you want to, not because you have to.

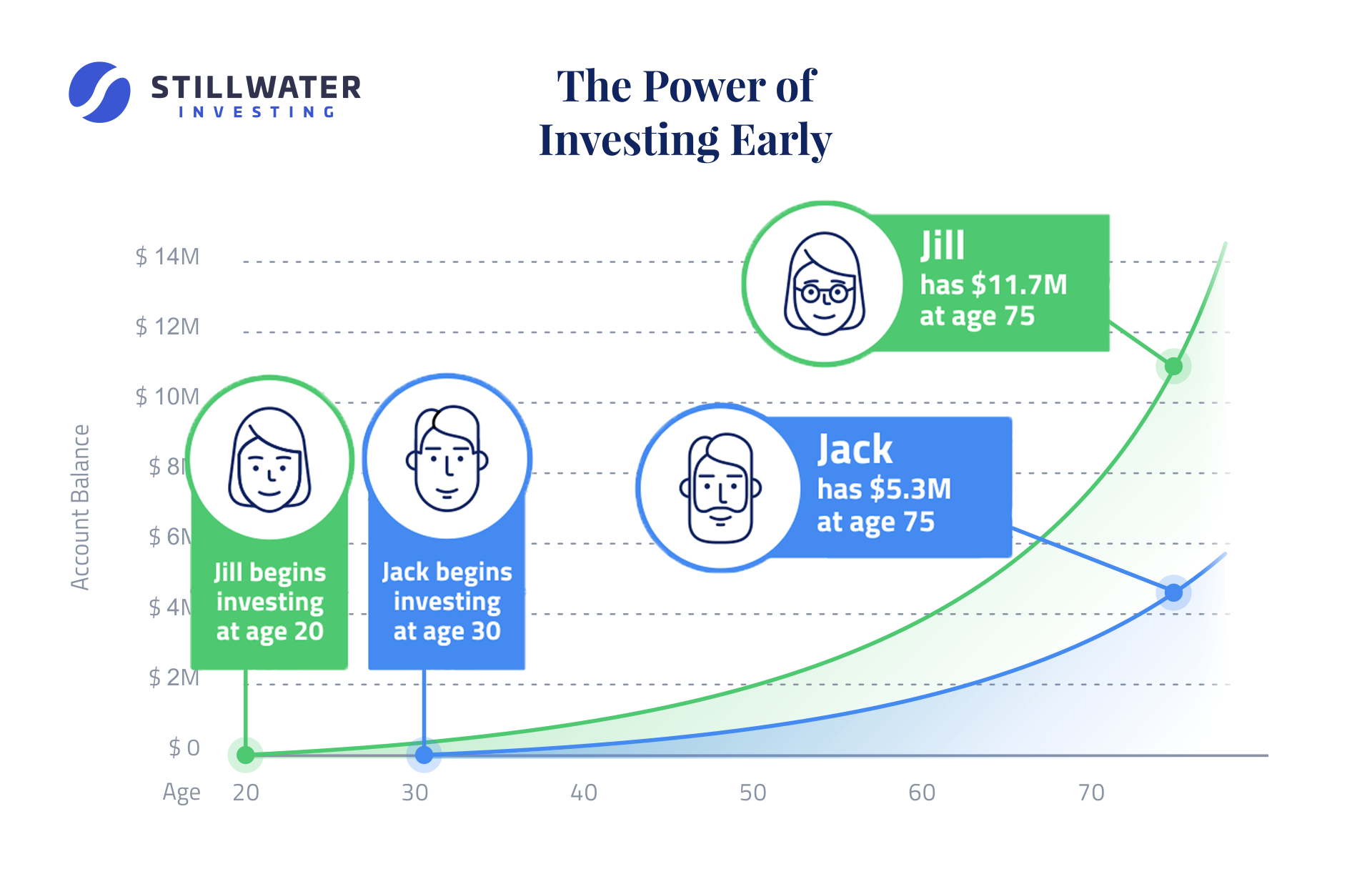

The Power of Investing Early

In this scenario, Jill begins investing at age 20, while Jack begins investing at age 30. Both invest $1000 a month and stop contributing after 45 years, with an average monthly return of 8%. By age 75, Jill’s account is valued at $11,707,580, while Jack’s is $5,274,539. Jill contributed the same dollar value over her lifetime, but her account is doubled because she started investing at an earlier age. In the end, each will have contributed $540,000 total.

Interest Calculator

Use this interactive calculator to see how compounding interest can impact your portfolio.

Average Worldwide Real Returns 1870-2015

| International Treasury Bills | Short Term Corporate Bonds | Equity

(stock ownership) |

|---|---|---|

| 1.03% | 2.53% | 6.88% |

*Jorda, Oscar, et al. “The Rate of Return on Everything, 1870–2015.” Mar. 2019.

RESULT

Account Balance

Starting Amount:

Total Contributions:

Total Interest Earned:

Total Account Value:

$0

* Interest is compounded monthly

Potential for loss

Investing is not guaranteed and accounts can lose money/value. An example is 500 companies, choosing individual securities/derivatives contracts and/or using borrowed money/leverage could cause even bigger losses. Investing has many variables that determine potential for loss. In terms of total returns adjusted for inflation, the three worst drawdowns of the S&P 500 since 1948 are:

1: The Global Financial Crisis (2007-2009): The S&P 500 experienced a drawdown of approximately 41.01% in real terms during the Global Financial Crisis, which was triggered by the collapse of the subprime mortgage market in the United States.

2: The Dot-Com Bubble (2000-2002): The S&P 500 experienced a drawdown of approximately 42.01% in real terms during the Dot-Com Bubble, which was fueled by speculation in the technology sector and ended with the bursting of the tech bubble.

3: The St. Patrick's Day Massacre (1972-1974) was a financial crisis that led to a drawdown of approximately 50.6% in real terms for the S&P 500. This crisis was triggered by Nixon's decision to break the Bretton Woods agreement, which resulted in the U.S. being taken off the gold standard. The U.S. government had increased the money supply to pay for the Vietnam War and social programs, and an OPEC embargo further caused the price of oil to rise.

Adjusting for inflation gives a better idea of the true impact of these drawdowns on investors' purchasing power, as inflation can erode the value of investment returns over time.